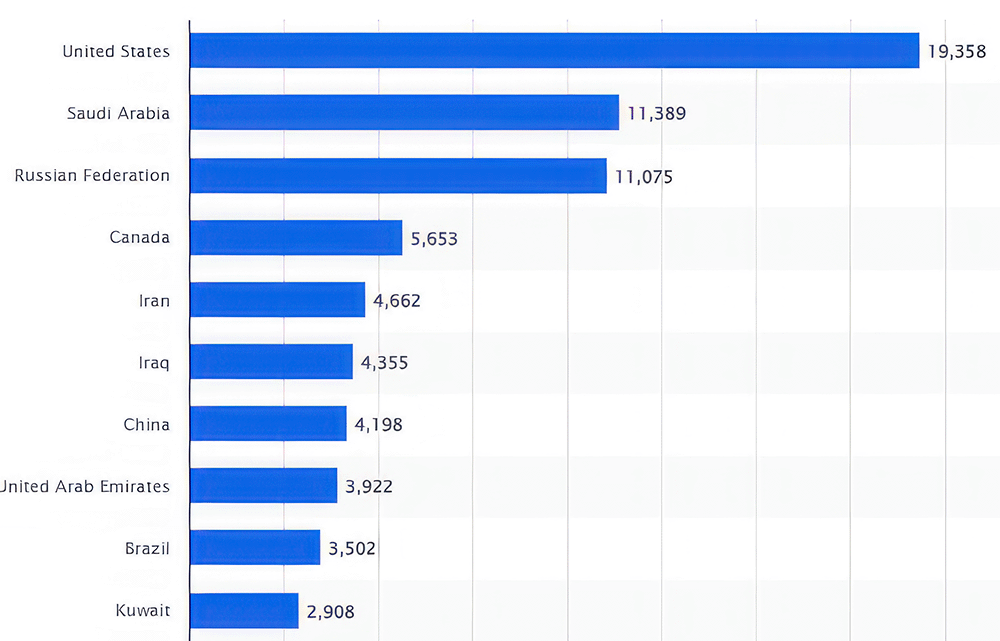

The USA and Saudi Arabia are ahead of Russia in oil production, with the gap from the Saudis being symbolic, while the USA has surged ahead sharply thanks to shale oil.

In terms of proven oil reserves at the end of 2022, Venezuela leads with 298.3 billion barrels (18.87% of global reserves), followed by Saudi Arabia with 266.4 billion barrels (16.87%) and Iran with 157.6 billion barrels (11.43%). Russia, in turn, has 94.0 billion barrels, accounting for 6.22% of the world's oil reserves.

OPEC countries, primarily Saudi Arabia, continue to play a key role in the global oil market, controlling about two-thirds of the world's reserves and providing roughly 35% of global production. This gives them significant influence over oil price fluctuations and decisions on production quotas.

Despite competition from the USA and Saudi Arabia, Russia remains an important player on the global oil stage. Its substantial reserves and role in global oil exports strengthen its position in the international energy system.

A key competitive advantage for Russia is the world's most extensive and powerful system of domestic and export oil pipelines, as well as over 450 million tons of liquid hydrocarbon transshipment capacity in seaports.

A distinctive feature of the Russian oil industry is the high degree of concentration of vertically integrated oil companies (VIOCs), which control all stages of the production cycle: from drilling and well construction to extraction, refining, marketing, and sales of the final product. The leading players in the Russian oil production and supply market continue to be companies such as Rosneft, Gazprom Neft, Lukoil, Tatneft, and Surgutneftegas. At the same time, about 50% of Russian oil production and refining has a high degree of state participation in capital, motivating the government to take an active role in the industry's development.

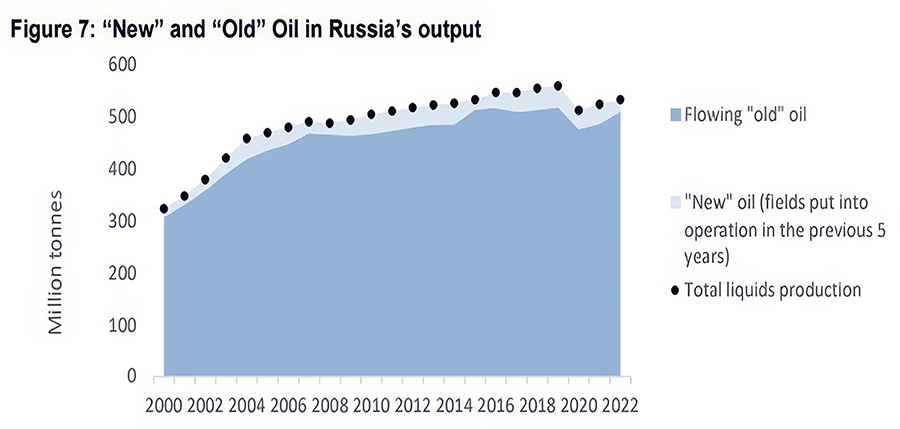

Moreover, over the past twenty years, Russian oil companies have achieved very good results in combating the decline in production of so-called "old" oil in Russia and have consistently expanded new capacities.

The Russian oil industry is relatively developed. One indicator of this maturity is that the majority of liquid hydrocarbon production in Russia comes from "old" fields. For example, in 2022, fields that had been in operation for more than five years accounted for 95.7% of the total liquid hydrocarbon production in Russia. Many of these fields passed their peak production some time ago and have been in a state of natural decline for many years. Notably, in Russian statistics, "new" fields are defined as those that have been in operation for less than five years; the composition of fields changes every year. Fluctuations in the "new" oil category are often associated with major fields exiting this category, as was the case in 2015 when production at the Vankor field exceeded the five-year mark.

The past few years have been very challenging for Russian oil producers. First, the slowdown in the global economy due to the COVID-19 pandemic led to an unprecedented drop in global oil demand in 2020. Additionally, since our country joined OPEC+, we have had to sharply reduce production to help stabilize and balance the global oil market. The unprecedented crisis demanded unprecedented responses, and in the spring of 2020, Russia committed to cutting crude oil production by nearly 2 million barrels per day.

Such a sharp reduction in production on this scale and in a very short time posed a significant technical challenge for Russian oil companies, as they faced the task of reducing production by 10-20% while simultaneously solving the complex problem of optimizing production and minimizing the risk of irreversible production losses.

The fact that Russian oil companies managed to survive the cuts and then resume production growth in 2021 and 2022 indicates that very little production capacity was lost, if any, after wells were shut down and subsequently restarted.

In recent years, state-owned companies have expanded their influence in Russia's oil production. This is especially true for Rosneft, which over the past decade has acquired Yukos, TNK-BP, and most recently, Bashneft. Another state-owned company, Gazprom Neft, acquired Sibneft's assets and is developing a portfolio of liquid assets on behalf of its parent company, Gazprom. However, production data by company, provided by the Russian Ministry of Energy, has retained the structure of the previous era, providing separate data on production for Bashneft and Slavneft (the latter jointly managed by Gazprom Neft and Rosneft), as well as reflecting oil production under production-sharing agreements (PSAs) ("Kharyaga," "Sakhalin-1," and "Sakhalin-2") as a separate category.