Historically, this sector accounted for between 3 and 3.5% of U.S. gross domestic product. A total of 9.7 million Americans are employed in this industry, representing about 5% of total private-sector employment. About 1 million jobs are directly involved in assembly, with an average wage of $29 per hour. Furthermore, each American automotive job creates nearly 10.5 other jobs in industries across the economy. In 2022, American companies invested $48.4 billion in automotive research and development (R&D), amounting to about 39 percent of global automotive R&D investment. The sector supports a whole ecosystem of U.S. manufacturers—from steelmaking to semiconductor production. For example, it forms the core of metalworking and related industries that retain important dual-use capabilities (such as the key roles Ford and GM played in the construction of tanks, vehicles, and aircraft during World War II).

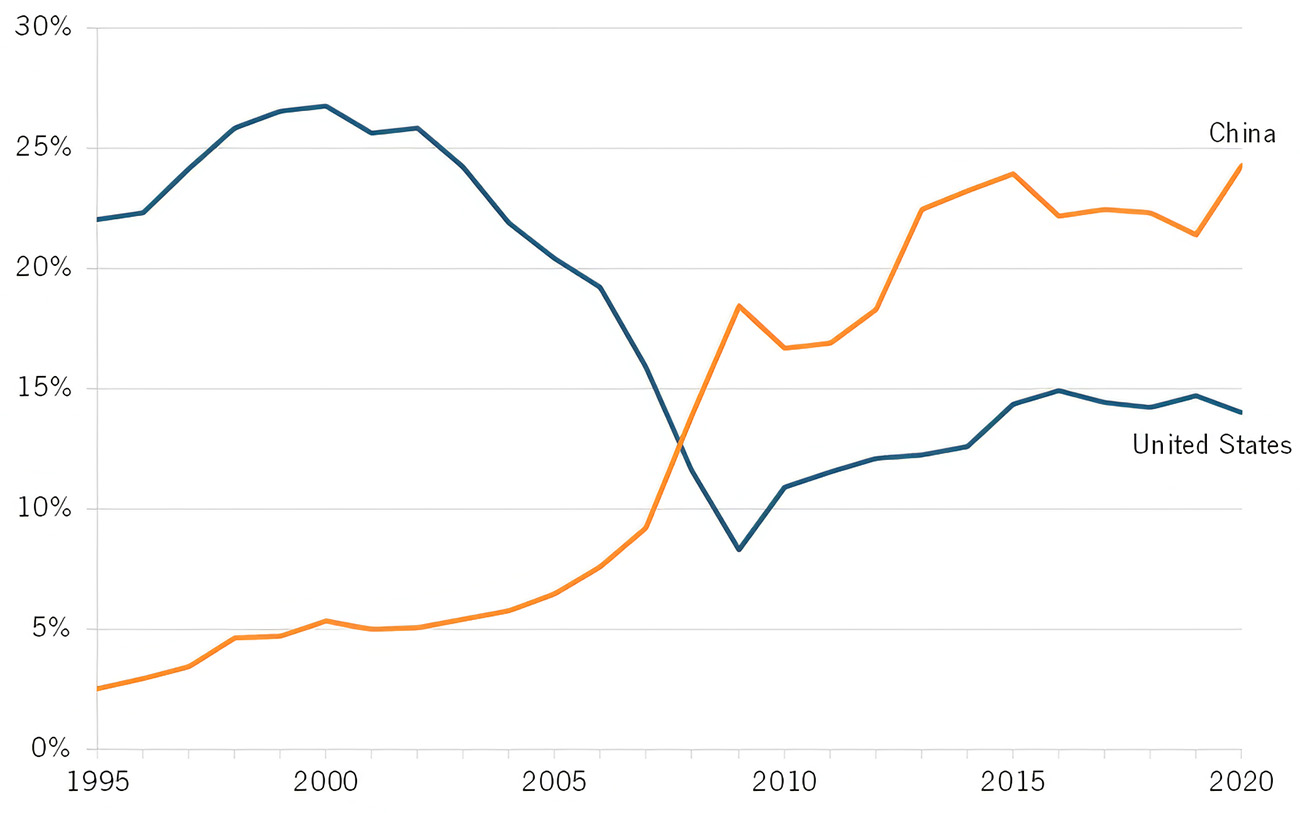

However, the former American automotive might is rapidly fading, suffering a powerful blow from China, which has been ahead of the U.S. in the global market for more than 15 years (Fig. 1). Notably, the most aggressive decline in the U.S. share began after 2001, when China joined the WTO.

China has now become not just a major force but the dominant player in global automobile production: from 5,200 passenger cars produced in 1985 to 26.8 million—21 percent of the world’s total—in 2024. In 2023, China surpassed Japan to become the world’s largest exporter of automobiles. If current global production trends continue, analysts forecast that by 2030 China will manufacture 36 million cars a year—four in every ten cars produced worldwide—as annual automotive exports reach 9 million vehicles, nine times higher than the 1 million exported in 2000.

China’s leadership in the electric vehicle market is even more impressive. In 2024, China produced about 70 percent of the 17.3 million electric vehicles made globally. That same year, it led the world in EV exports—1.25 million units, accounting for 40 percent of the global market. Similarly, China’s battery production capacity in 2022 stood at 0.9 terawatt-hours, roughly 77 percent of the global total. China has also established an almost complete monopoly in the production of battery components for EVs, supplying nearly 85 percent of active cathode materials—including nickel-manganese-cobalt (NMC) and lithium-iron-phosphate (LFP) compounds—and over 90 percent of active anode materials.

Finally, China has already achieved leadership in innovative EV manufacturing technologies. Chinese automakers now outpace nearly all competitors across the entire EV supply chain. For instance, Chinese company BYD is developing “instant charging” technology—a charger/battery system that, according to the company, “can add two kilometers of range per second or 400 kilometers in five minutes,” three times faster than Tesla’s Supercharger (and faster on average than smartphone charging). In short, China isn’t just leading the global EV market—it’s accelerating further ahead. The pace of technological renewal in Chinese EV model lineups has reached staggering levels: Chinese EVs are sold for an average of 1.3 years before being updated or refreshed, compared to 4.2 years for foreign brands.

Today, the scale of China’s automotive industry as a whole—and its advanced electric vehicle sector in particular—has reached such impressive dimensions that it demonstrates complete economic superiority over competitors. In 2018, more than 500 electric vehicle startups were registered in China; by mid-2024, their number had fallen to around 200, and by August 2025—to about 130. Nevertheless, there remains a significant surplus in Chinese EV production capacity—between 5 and 10 million vehicles per year.

The achieved economies of scale in EV manufacturing are a key factor enabling the sector to produce electric vehicles at lower cost and accelerate innovation. Spreading R&D costs over growing production and sales volumes helps Chinese companies both reduce production and retail costs and increase investment in innovation. According to one estimate, the cost of manufacturing Chinese EVs is half that of European ones, thanks to achieved technological superiority.

Thus, the Chinese electric vehicle dragon has spread its wings, covering the planet with its power. Yet this “dracarys” has advanced at lightning speed—from a barely hatched creature crawling along its mother’s body to a fully grown dominant predator. The secrets of this acceleration will be revealed in the next article.